The eye-watering cost of social care will be presented to all households in Swindon when council tax bills begin dropping on doormats this week.

A brightly coloured booklet will be included with people’s annual council tax bills explaining how Swindon Borough Council spends its money and how 80 per cent of its day-to-day budget pays for services to look after a relatively small proportion of adults and children who require support.

Last year, for example, the Council spent £21.6m on placing an average of 265 children in care placements, £27.8m was spent on providing residential or nursing care for 567 people, while £15.6m paid for supported living care for 194 people.

In Swindon, council tax will increase by 4.99 per cent for the next financial year as the Council looks to close an unprecedented budget gap caused by record levels of inflation and service cost pressures.

But while local people will be asked to pay more to the local authority from next month, the booklet accompanying this year’s bills provides a number of case studies to illustrate how council taxpayers are making a real difference to people’s lives.

It explains how providing a care placement for one child costs on average £81,300 per year and that an average care package for an adult costs £24,365 a year.

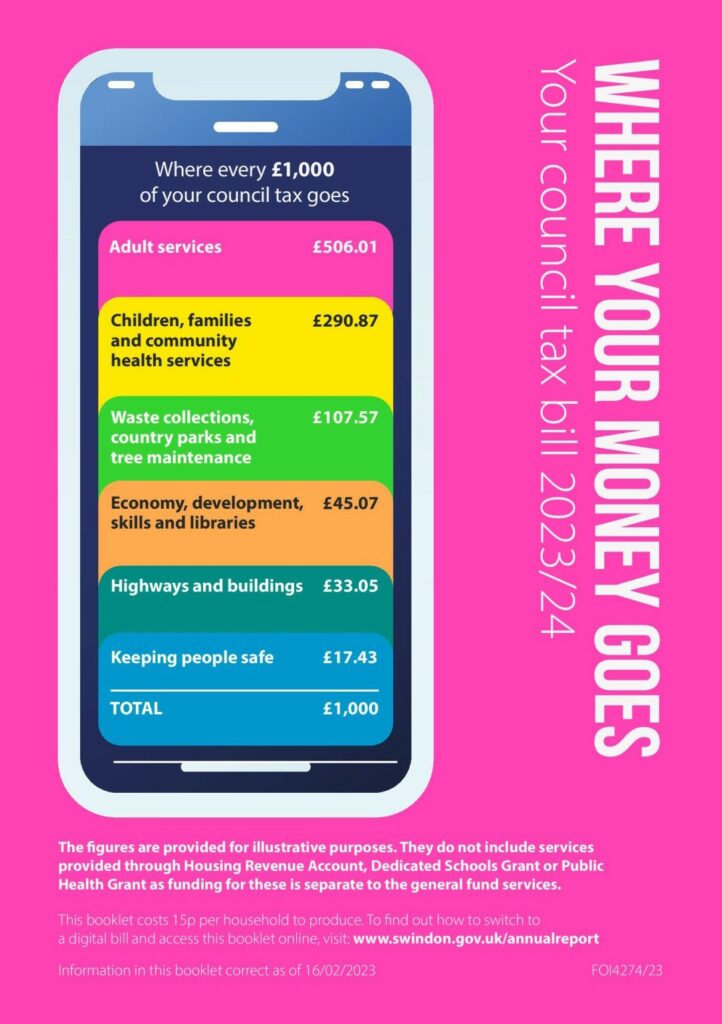

The Council’s net budget for 2023/24 is £166.4m, which is made up of business rates collected locally (£35.8m), government grants (£5.2m), and the amount raised through council tax (£125.4m).

Of that net budget, more than half (£84.2m) will be spent on Adult services with a further 29.1 per cent (£48.4m) being spent on Children, Families and Community Health services.

Yet, although the majority of the budget will be spent on support that most people do not need, the Council is continuing to provide hundreds of services for Swindon’s residents from the remaining 20 per cent of the money it has available.

These include providing approximately 10m waste and recycling collections each year, and paying for services such as libraries, museums and country parks. Planning services, road maintenance, streetlights, and regulatory services such as Trading Standards and food hygiene inspections are also highlighted as examples of services that come under the remaining 20 per cent of the Council’s net budget.

Later this year, the Council will also begin extending its food waste collection service to all households in the Borough.

Outside of the Council’s day-to-day budget, millions of pounds in additional funding secured from successful bids to the Government is also being spent on upgrading major road junctions and various projects to regenerate and rejuvenate Swindon’s town centre. This is funding which can only be spent on the specific projects it was intended for and is separate to council tax.

Councillor David Renard, Leader of Swindon Borough Council, said: “Soaring inflation and cost pressures within our services have created the most challenging budget setting process that I have ever experienced.

“It is an unprecedented situation which has forced us to find £26m in savings for the next financial year. This has resulted in us having to make some tough decisions none more so than the 4.99 per cent increase in council tax.

“All residents are facing huge financial pressures at the moment and asking them to pay more next year is not a decision councillors took lightly.

“However, that extra money will make a huge difference to the lives of so many people and I would encourage people when they receive their bills to spare just a few minutes to read the accompanying council tax booklet so they can see for themselves how we are maximising our funding for the benefit of all Swindon residents.”

More information on the Council’s budget, including a copy of this year’s council tax booklet, can be found on the Council website here: www.swindon.gov.uk/annualreport